Bitcoin Is Not a Valid Currency

Bitcoin, in several ways, fails as a currency. Thus, the hype around it is an obvious bubble to which investors should look away from, and not try and jump on an already overheated train. Nevertheless, it does have a few elements that do work in its favor as a currency.

The first parameter for a good currency is to be widely accepted. While several vendors do accept bitcoin, huge retailers such as Amazon and Walmart do not accept bitcoin. Granted, acceptance of bitcoin is growing, but many multinational firms are still not onboard, for a number of reasons that will be discussed below.

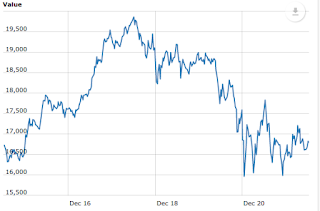

Lack of acceptance is a minor concern compared to bitcoin’s insane fluctuations that fundamentally destroy its usability as a currency. Below is a weekly chart of bitcoin’s price, from December 16th to December 20th.

The price shot up by 25%, to almost 20,000 dollars in 2 days, before dropping the same amount in 3 days. This is unheard of from any currency. The US dollar, Euro, and Yen make moves of 10% over the course of a few years, not a few hours. Even most stocks do not fluctuate by even more than a few percentage points each day. Bitcoin is indeed one of the most volatile financial assets currently on the market, which makes it entirely useless as a currency. No consumer nor store owner wants to check the price of bitcoin every hour and change prices accordingly. Widespread adoption of bitcoin is therefore impossible unless bitcoin’s volatility shrinks by several orders of magnitude.

This isn’t to say that bitcoin has a few things going for it. For instance, every currency needs to be divisible into smaller units - a dollar into cents, a rupee into lakh - and bitcoin doesn’t fail in this regard. Bitcoin is also durable. Only an EMP attack, which is a nuclear device detonated in the atmosphere with the intention of wiping out the power grid, could bring down bitcoin. Additionally, bitcoin is practically impossible to counterfeit - to do so would require a monstrously powerful computer that far exceeds anything else on the planet.

But what about governments? Especially in recent years, expansionist monetary policies such as quantitative easing have been used to artificially drive down interest rates and thus stimulate the economy. This is the type of behavior that bitcoin fundamentally goes against. Only 21 million bitcoins can ever be mined, and the mining is controlled by a plethora of different entities - corporations on wall street and people on main street alike. Thus, bitcoin has no central authority, and is instead a totally decentralized network. This makes monetary policy impossible to conduct by any government. Therefore, it is unlikely that governments will adopt bitcoin in the near future.

Bitcoin and cryptocurrency in general are both extremely promising ideas that are meant for the 21st century. However, in their current manifestation, they do not seem to fit within our world. Only time will tell whether bitcoin or some other cryptocurrency will become commonplace in the future.

Comments

Post a Comment